The Facts About Property By Helander Llc Uncovered

The Facts About Property By Helander Llc Uncovered

Blog Article

Some Known Details About Property By Helander Llc

Table of ContentsThe Facts About Property By Helander Llc UncoveredThe Facts About Property By Helander Llc UncoveredThe Best Guide To Property By Helander LlcProperty By Helander Llc for DummiesProperty By Helander Llc - TruthsOur Property By Helander Llc Diaries

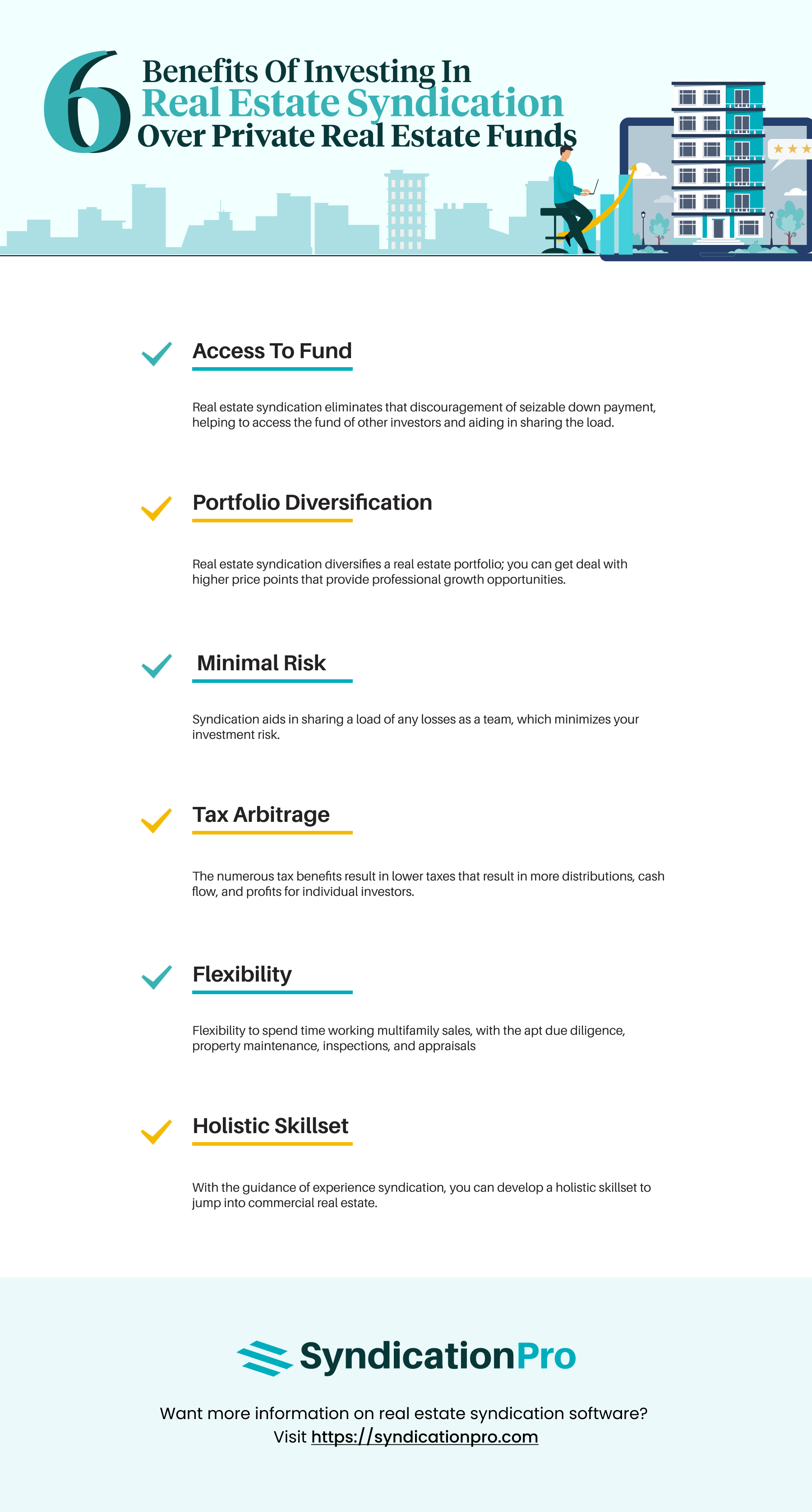

The advantages of purchasing real estate are various. With appropriate properties, financiers can enjoy predictable cash money flow, exceptional returns, tax obligation advantages, and diversificationand it's feasible to leverage property to construct wealth. Believing concerning buying genuine estate? Below's what you need to understand regarding actual estate benefits and why property is considered an excellent investment.The benefits of investing in realty include passive earnings, steady capital, tax advantages, diversity, and utilize. Property investment counts on (REITs) use a means to purchase property without having to have, operate, or finance buildings - (https://sandbox.zenodo.org/records/120443). Capital is the net earnings from a realty financial investment after mortgage repayments and business expenses have actually been made.

In most cases, capital just reinforces over time as you pay down your mortgageand accumulate your equity. Investor can make the most of various tax obligation breaks and reductions that can conserve money at tax time. Generally, you can subtract the reasonable prices of owning, operating, and managing a residential property.

The Facts About Property By Helander Llc Uncovered

Real estate worths often tend to enhance over time, and with a great financial investment, you can turn a revenue when it's time to offer. As you pay down a property mortgage, you construct equityan property that's part of your web well worth. And as you develop equity, you have the utilize to acquire even more buildings and increase cash flow and wealth also more.

Because real estate is a tangible property and one that can offer as security, financing is conveniently offered. Actual estate returns differ, depending on aspects such as place, property course, and administration.

Property By Helander Llc - Truths

This, consequently, equates into higher capital worths. Real estate has a tendency to maintain the buying power of resources by passing some of the inflationary stress on to renters and by including some of the inflationary stress in the form of capital admiration. Mortgage financing discrimination is prohibited. If you think you've been victimized based upon race, religious beliefs, sex, marital status, use of public support, nationwide beginning, disability, or age, there are steps you can take.

Indirect actual estate investing entails no direct ownership of a property or homes. Instead, you buy a pool along with others, whereby a monitoring business has and operates homes, or else possesses a profile of mortgages. There are several manner ins which owning actual estate can secure against inflation. Residential or commercial property worths might rise greater than the rate of rising cost of living, leading to funding gains.

Properties funded with a fixed-rate lending will see the relative amount of the month-to-month home mortgage repayments fall over time-- for circumstances $1,000 a month as a fixed settlement will certainly become less burdensome as inflation erodes the buying power of that $1,000. (http://prsync.com/property-by-helander-llc/). Typically, a main home is not taken into consideration to be an actual estate financial investment since it is used as one's home

The 20-Second Trick For Property By Helander Llc

Despite having the assistance of a broker, it can take a linked here couple of weeks of work just to locate the appropriate counterparty. Still, realty is a distinctive property class that's straightforward to recognize and can improve the risk-and-return profile of a capitalist's profile. By itself, realty uses capital, tax breaks, equity building, affordable risk-adjusted returns, and a hedge versus inflation.

Buying realty can be an exceptionally satisfying and profitable endeavor, but if you resemble a whole lot of brand-new financiers, you may be wondering WHY you ought to be purchasing property and what advantages it brings over various other investment chances. In addition to all the fantastic benefits that come along with spending in real estate, there are some disadvantages you require to consider.

Little Known Questions About Property By Helander Llc.

If you're searching for a method to acquire into the property market without having to spend thousands of hundreds of dollars, have a look at our residential properties. At BuyProperly, we make use of a fractional possession version that allows capitalists to begin with as little as $2500. One more major benefit of genuine estate investing is the capacity to make a high return from buying, refurbishing, and marketing (a.k.a.

Property By Helander Llc Things To Know Before You Buy

As an example, if you are charging $2,000 rent each month and you sustained $1,500 in tax-deductible expenditures monthly, you will just be paying tax on that $500 revenue monthly. That's a large difference from paying taxes on $2,000 each month. The revenue that you make on your rental unit for the year is considered rental income and will be exhausted accordingly

Report this page